SBI Magnum Taxgain Scheme Mutual Fund – Features & Benefits Explained

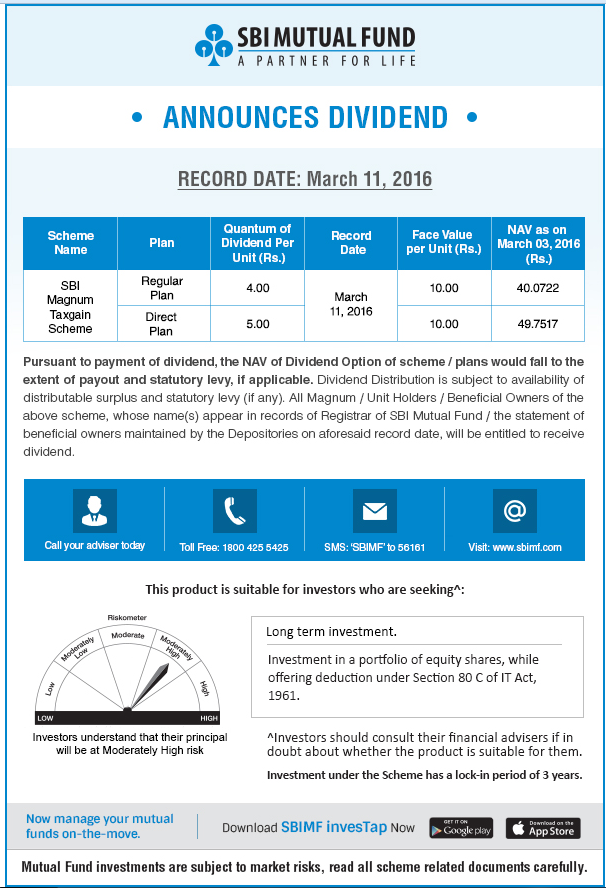

The SBI Magnum Taxgain Scheme mutual fund is one of the most popular tax-saving investment options in India. Launched in 1993, this Equity Linked Savings Scheme (ELSS) has been a reliable choice for investors looking to save taxes under Section 80C of the Income Tax Act while building long-term wealth. With a mandatory 3-year lock-in period and the potential for high returns, the scheme offers a balanced approach to tax savings and capital appreciation. In this article, we provide an in-depth analysis of the SBI Magnum Taxgain Scheme, including its features, benefits, performance, and answers to frequently asked questions.

Key Features of SBI Magnum Taxgain Scheme

-

Type of Fund:

-

Open-ended Equity Linked Savings Scheme (ELSS) with tax-saving benefits under Section 80C.

-

-

Lock-In Period:

-

A mandatory lock-in period of 3 years, making it one of the shortest among tax-saving instruments.

-

-

Investment Objective:

-

To provide long-term capital appreciation through investments in equity and equity-related instruments.

-

-

Tax Benefits:

-

Investors can claim deductions of up to ₹1.5 lakh per year under Section 80C of the Income Tax Act.

-

-

Minimum Investment:

-

₹500 for SIPs and lump-sum investments, making it accessible for all types of investors.

-

-

Risk Level:

-

Moderately high risk, suitable for investors with a long-term horizon and a higher risk appetite.

-

-

Benchmark Index:

-

S&P BSE 500 Total Return Index (TRI).

-

Benefits of Investing in SBI Magnum Taxgain Scheme

-

Tax Savings:

-

Save up to ₹46,800 annually (for taxpayers in the highest tax bracket) by investing up to ₹1.5 lakh under Section 80C.

-

-

High Return Potential:

-

The scheme has delivered an average annual return of 16.43% since inception, outperforming many traditional tax-saving instruments like PPF and FDs.

-

-

Short Lock-In Period:

-

Compared to other tax-saving options like PPF (15 years) or NSC (5 years), the 3-year lock-in period is significantly shorter, offering better liquidity.

-

-

Power of Compounding:

-

Long-term investments through SIPs can yield substantial returns due to compounding benefits over time.

-

-

Portfolio Diversification:

-

The fund invests across sectors like financials, technology, energy, healthcare, and metals & mining, ensuring balanced growth.

-

Know More about Bihar Clock Tower 40 Lakh | Controversy Explained & Official Clarifications

Performance Overview

As of April 2025, the SBI Magnum Taxgain Scheme has shown consistent performance over various time horizons:

| Time Period | Returns (%) | Category Average (%) |

|---|---|---|

| 1 Year | 7.69% | 6.07% |

| 3 Years | 22.81% | 14.61% |

| 5 Years | 31.37% | 26.61% |

| Since Inception | 16.43% | N/A |

The fund’s assets under management (AUM) stand at ₹27,730 crore as of March 31, 2025, reflecting its popularity among investors.

Who Should Invest in SBI Magnum Taxgain Scheme?

This scheme is ideal for:

-

Salaried individuals looking to save taxes while building wealth.

-

First-time mutual fund investors seeking exposure to equity markets.

-

Investors with a minimum investment horizon of three years.

-

Those with a moderately high-risk appetite aiming for long-term capital appreciation.

How to Invest in SBI Magnum Taxgain Scheme Mutual Fund?

Investing in this mutual fund is simple and can be done through various platforms:

-

Official Website: Visit the SBI Mutual Fund website and complete your KYC process if not already done.

-

Investment Platforms: Use platforms like Groww, Zerodha Coin, or Paytm Money for seamless online transactions.

-

Bank Branches: Visit your nearest SBI branch to invest offline.

-

Registered Distributors: Approach AMFI-certified mutual fund distributors for guidance.

FAQs About SBI Magnum Taxgain Scheme Mutual Fund

Q1: What is the SBI Magnum Taxgain Scheme Mutual Fund?

The SBI Magnum Taxgain Scheme is an ELSS mutual fund that offers tax-saving benefits under Section 80C while aiming to provide long-term capital appreciation through equity investments.

Q2: What is the lock-in period for this SBI Magnum Taxgain Scheme Mutual Fund?

The scheme has a mandatory lock-in period of three years.

Q3: How much can I invest in this SBI Magnum Taxgain Scheme Mutual Fund?

You can start investing with as little as ₹500 through SIP or lump-sum investments.

Q4: What are the tax benefits?

Investments up to ₹1.5 lakh per year are eligible for deductions under Section 80C of the Income Tax Act.

Q5: Is this scheme suitable for first-time investors?

Yes! It’s an excellent choice for first-time investors due to its dual benefits of tax savings and wealth creation.

Q6: Can I redeem my investment before three years?

No, you cannot redeem your investment before completing the mandatory three-year lock-in period.

Q7: What kind of returns can I expect?

While past performance is not indicative of future results, the scheme has delivered an average annual return of over 16% since inception.

Q8: Is there any risk involved?

Yes, being an equity-based mutual fund, it carries moderately high risks but also offers higher return potential compared to traditional instruments.

Know More about Delhi NCR Dust Storms April 2025

Comparison with Other Tax-Saving Options

| Instrument | Lock-In Period (Years) | Expected Returns (%) | Tax Benefit (₹) |

|---|---|---|---|

| SBI Magnum Taxgain | 3 | 12–15 | Up to ₹46,800 |

| Public Provident Fund (PPF) | 15 | 7–8 | Up to ₹46,800 |

| National Savings Certificate (NSC) | 5 | ~6 | Up to ₹46,800 |

Conclusion

The SBI Magnum Taxgain Scheme mutual fund is a powerful investment tool that combines tax savings with long-term wealth creation potential. With its short lock-in period, high return potential, and diversified portfolio, it stands out as one of the best ELSS options available today. Whether you’re a seasoned investor or just starting your financial journey, this scheme offers a balanced approach to achieving your financial goals while saving on taxes.

So why wait? Start your investment journey today and take advantage of this smart financial tool!

0 Comment