New Invoice Rules Under Gst | 2025

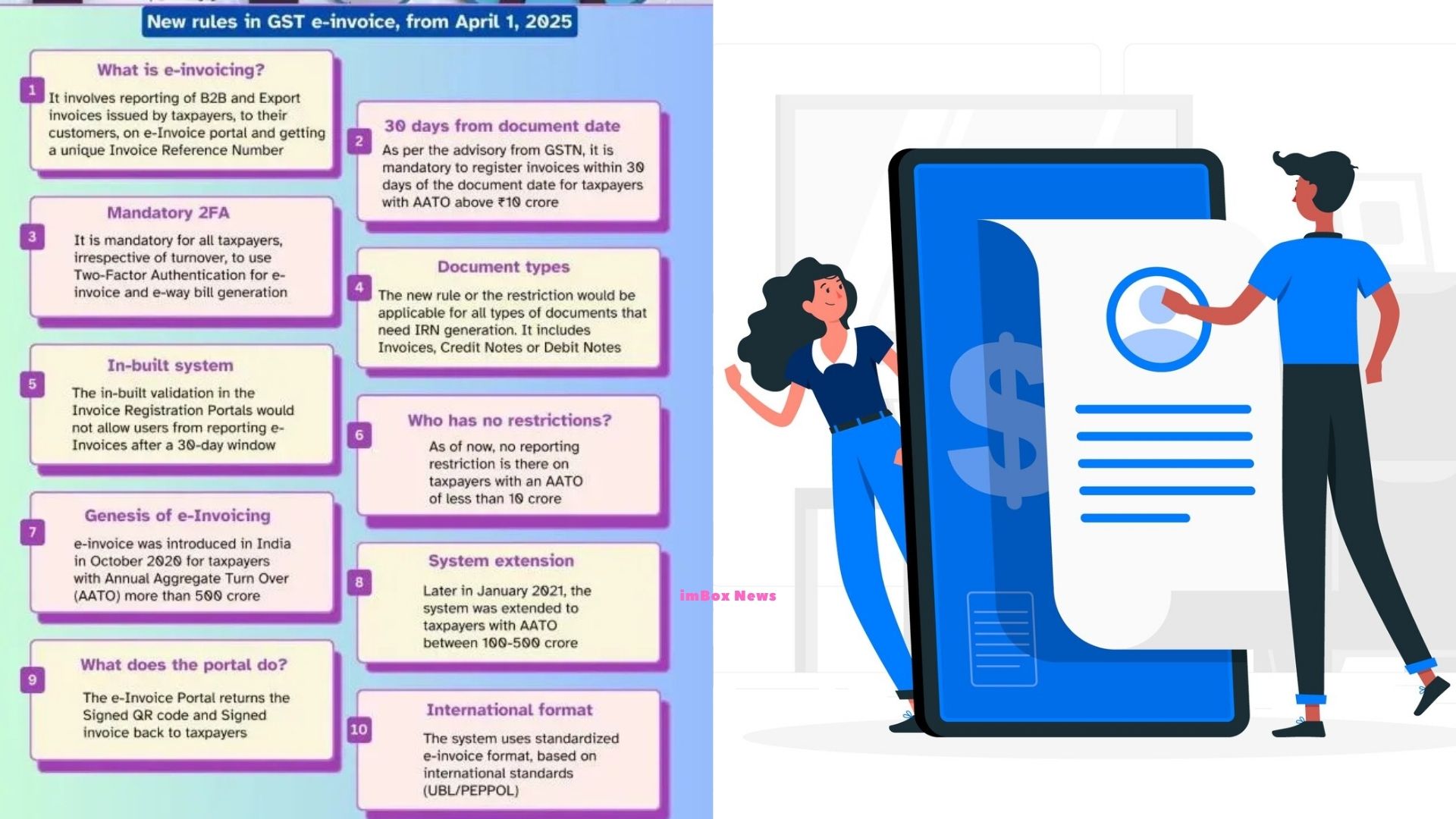

Changes on invoicing rules as per GST system (New Invoice Rules Under Gst- 2025) have been many in India under Goods and Services Tax (GST) which is from April 1, 2025. The purposes for these changes are to drive better compliance, more streaming and an increase in corporate transparency. Tax pros and business owners need to learn the GST invoicing laws of change so as not to be penalised for not complying, and to help their corporate environment function properly

From now on, firms with revenue above ₹10 crores must resort to electronic invoicing

Electronic invoices are required to be issued and submitted to the Invoice Registration Portal (IRP) within 30 days of issue by the business entities engaged in inter-state and taxable activities and having turnover exceeding ₹10 Crore as on 1 st April, 2025. The prior hurdle was at ₹100 crore so its a big jump.

What “New Invoice Rules Under Gst” Means For Businesses:

- Invoices taking no more than 10 mins of processing means no IRP rejection.

- Failure to invoice could cost you Input Tax Credit (ITC).

- Invoicing systems need to be updated for real-time compliance of businesses.

New Tax Financial Year — Fresh Invoice Series Required

As it is mandatory for GST compliance one thing that we must do is start delivering the fresh invoice series from April 1,2025.

If this rule pertains to all registered businesses and is intended to provide a level of uniformity in the management of your invoice trail.

Why Is This Important– For the proper tracking of invoices of new financial year.

Aids in scrapping of invoices that are using outdated GST formats causing errors in GST return filing.

Get an obligation to admit Input Service Distributor ( ISD)-From today onwards, all businesses operating across different states under one PAN will have to register as Input Service Distributors (ISD). This implies that they have to issue the ISD invoices and must file GSTR-6 returns for distribution of ITC among various branches.

Do You Know- You Can Use PS4 Controller on PS5.

ISD Registration Benefits:

1. Eases the distribution of ITC for shared services such as rent or consultancy fee.

2. Better compliance and disclosure in ITC Awaits.

Their changes for GSTIN Form,GSTR-7 and GSTR-8 form- The government has updated their GSTR-7 and GSTR-8 forms formats. These changes are targeted at collecting in-depth transaction data, particularly for the e-commerce operators on TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) Filings.

More Criminal Rules for E-Way Bill applicable- The new rules further make the task of generation and extension of e-way bills much job tougher and cumbersome for business. When transporting goods, companies are now required to abide by more rigid timeframes and report.

Key Takeaway:

1. Give prompt generation of e-way bill to prevent penalty, stoppage of goods.

2. The Role of Invoice Tracking in Real Time becomes a lot more critical.

3. SO in the new system, businesses have to upload their invoices immediately to IRP. This minimizes error, eliminates potential 4. ITC scamming and keeps the tax authorities up to date on who did not transact.

Read More About- kancha gachibowli forest hyderabad

Penalties on Non-Compliance

1.Failure to adhere with New Invoice Rules Under Gst can greatly result into strict penalties:

2. ETT of invoices which are not uploaded within time will be rejected in IRP

3. This will disallow ITC and result on loss as well.

4. Fines or actual legal liability may also be taken of non-compliance.

What can Businesses do to be ready for these changes?

In order to ensure compliance well with the New Invoice Rules Under Gst, let see what steps companies can take:

1. Dress Up Your Invoicing Software: Your system should be up-to-date in respect of the new GST.

2. Teach Your Team: Make sure your team is aware of the new invoicing dates and howBilling will be done.

3. Keep an Eye On Deadline: Develop internal tracking of invoice uploads and e-way bill creation.

4. Take Counsel: Use the services of GST consultants/advisors if requisite.

Read More About-Jpmorgan global recession 2025

FAQ’s about New Invoice Rules Under Gst

Q1. What is the e invoice limit for 2025?

Starting April 1, 2025, such businesses are required to report their e-invoices on the Invoice Registration Portal (IRP) within 30 days of the invoice date.

Q2. What are the new rules for GST e-invoice?

Starting April 1, 2025, significant changes to the GST e-invoice system will be implemented. Businesses with an Annual Aggregate Turnover (AATO) of ₹10 crore or more are required to report their e-invoices within 30 days of the invoice date. This rule aims to enhance compliance and reduce fraud.

Q3. Is the 10 crore e-invoice limit applicable?

No, it’s now ₹5 crore

Q4. What is the limit of cash invoice in GST?

Under GST, there is no specific limit for cash invoices. However, as per Section 269ST of the Income Tax Act, cash transactions exceeding ₹2,00,000 in aggregate from a single person in a day, for a single transaction, or related to one event are prohibited.

Q5. What are the new GST rules?

Here are some of the key new GST rules effective from April 1, 2025:

-

Mandatory Multi-Factor Authentication (MFA): All taxpayers must use MFA for accessing the GST portal to enhance security.

-

Stricter E-Way Bill Regulations: E-way bills now have stricter generation and extension rules to prevent fraud.

-

Mandatory Input Service Distributor (ISD) Registration: Businesses with multiple GST registrations under one PAN must register as ISD to distribute ITC.

-

New Invoice Series: All taxpayers must start a fresh invoice series from April 1, 2025, with sequential and non-repetitive numbering.

-

Lowered E-Invoicing Threshold: The threshold for mandatory e-invoicing has been reduced to ₹5 crore.

Conclusion on New Invoice Rules Under Gst | 2025

The introduction of New Invoice Rules Under Gst is another initiative for better transparency and valuation in India tax tape. Those changes may sound difficult, but also provide a chance for businesses to automate processes and directly improve compliance.

Following the above updates, keep yourself in loop & take necessary steps for early implementation; thereby businesses can get rid from penalty, seamless ITC claim and get added to best GST ecosystem.

The write up in this blog has purposefully been created using a more basic language yet the focus keyword — New Invoice Rules Under GST is naturally put multiple times in the content for better SEO performance while preserving readability.

0 Comment